Innovation and trust go hand-in-hand at the NYSE

The New York Stock Exchange leads with seven of the 10 largest IPOs in 2025, paves way for digital currency public market debuts

Learn moreCapital markets happen here

The NYSE is capitalism at its best, the belief that free and fair markets offer every individual the chance to benefit from success.

We set the standard with our unparalleled trading platform, enabling entrepreneurs, innovators, and investors to raise the capital they need to change the world. We want to share our vision for good governance, transparency, and trust with our listed community, furthering the responsible development of global business. You work too hard to list anywhere else.

Learn more

Today’s Stock Market

February 24, 2026 at 1:30 p.m. EST

The celebratory mood after the US Hockey Golden sweep over the weekend quickly evaporated during yesterday’s session as the AI disruption narrative picked up further steam fueled by a Citrini Research report that made its way around social media. The report pointed to a dystopian not too distant future where unemployment exceeds 10% as AI transforms the economy. Word of caution do not read before bedtime, I made that mistake on Sunday evening, but didn’t think it would have such a widespread market impact. Comments from Nassim Taleb, author of The Black Swan, discussing software bankruptcies and mispricing of structural risk added to the bearish fodder. The AI Anxiety overshadowed the looming questions around trade after Friday’s Supreme Court decision. President Trump quickly instituted a 10% global tariff under Section 132 and then raised the rate just 24 hours later. The fact that we were coming out of options expiration, where some protection rolled off, and trading desks were half manned after the storms, may have added to the volatility as well.

The S&P 500 fell ~1% closing right around Friday’s low and just over the rising 100d ma (~6,825). Software continued to be under pressure with the private credit concerns spreading more broadly into financials with the sector falling >3%. Payment processors also got hit hard following the Citrini report. JP Morgan CEO Jamie Dimon who likes to give forecasts and tends to have a pragmatic view, warned of similarities ahead of the GFC saying some financial firms were “doing some dumb things”. Recall his “cockroach” comments about private credit back in October amidst the First Brands/Tricolor bankruptcies. He did say that the company would be an AI winner pushing back against some the claims in the Citrini report about the transformation of payments systems. In the afternoon IBM (-13%) became the most recent Claude Casualty after Anthropic said Claude Code could be used to modernize COBOL (Common Business-Oriented Language) which is used in business data processing. Sectors ending the session higher included defensive consumer staples/healthcare, commodity and yield oriented sectors.

Ahead of this evening’s State of the Union Address equities are bouncing back recouping about half of yesterday’s losses. Zooming out the S&P 500 continues to ping pong between its 100/50d moving averages trapped in a ~250pt range for the last three months.

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

| Description | Last | Change (%) |

|---|

Market data delayed minimum of 15 minutes

![What's next [fade-up]](https://www.ice.com/publicdocs/images/NYSE-homepage-pattern-02.svg)

What’s next?

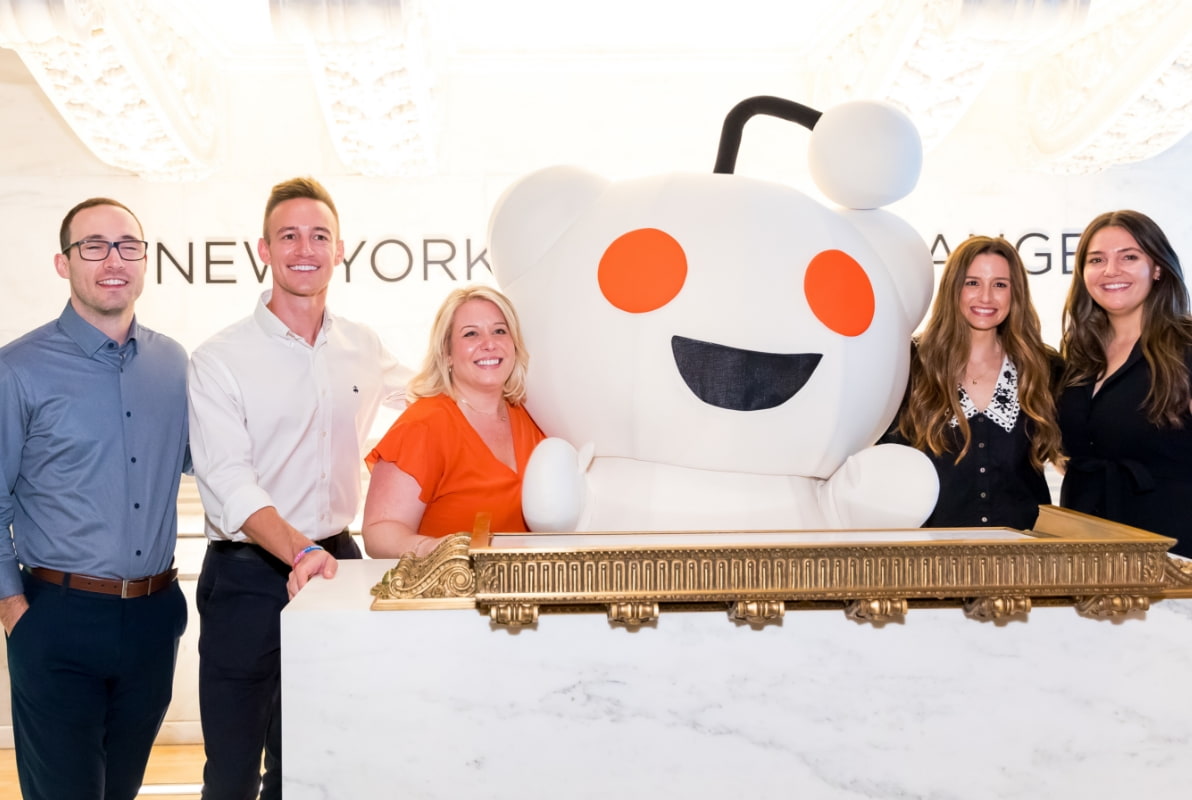

The NYSE looks forward to welcoming more leading companies from around the world in 2026, growing our one-of-a-kind community and setting the pace for innovation on a global scale. We’re endlessly inspired by the people behind these companies, check out their stories below and let’s make something happen together.

Going public

What does it take to go public? Ryan Hinkle draws on twenty years of investing at Insight Partners, one of the most prolific global software investors, and shares his advice for SaaS startups preparing to go public.

Making their mark

Entrepreneurs come to the NYSE to realize their ideas and change the world. We teamed up with 3M’s Post-it® Brand to encourage future leaders visiting our building to take a step toward making their goals and dreams happen. Watch as interns from Life Science Cares’ Project Onramp make their mark.

The Cure(ious)™

We asked some of the most curious minds in life sciences and healthcare to share thoughts on their careers, the future of health and more. Each participant drew questions and shared their insights, knowledge and some personal fun facts that left us inspired about the future of health and wellness.